Use Customer Insights to Increase Sales

Marketers typically think of customer interviews as the main or only source of customer insight. We have a more inclusive process. Customer insight should also be taken from:

- email response requests

- support requests

- listening in on sales calls

- reviewing customer testimonials

- reviewing competitor testimonials

- evaluating customer site search behavior

- evaluating customer in-product behavior

Collecting information from these sources will arm your marketing team with insight for pain point messaging content development most of your competition doesn’t know how to do.

For example, consider the boot and leather conditioner manufacturer we worked with that was targeting the long-tail keyword phrase:

best leather conditioner for boots

This phrase has decent traffic and with five words the cost-per-click in paid search is affordable.

Unfortunately, this manufacturer only targeted the most bottom-of-funnel actions: “Buy Now.” The company didn’t build other landing pages to see if pain-point content might sell more product.

Consider shoppers searching “best leather conditioner for purses” and finding an insufficient set of choices. Such shoppers might be searching for boot conditioning products to shine and restore leather on other items like purses, etc. Thinking about all the angles of customer intent and completing items in that column on your keyword phrase spreadsheet will allow you to write new content that speaks to customer pain: content that immediately engages visitors and increases conversions.

The Mirriam-Webster Dictionary defines ‘insight’ as:

1 : the power or act of seeing into a situation: PENETRATION

2 : the act or result of apprehending the inner nature of things or of seeing intuitively

Customer insights explain behaviors around products and markets. Analyzing and reporting customer insights allows companies to:

- optimize their business model

- predict behaviors and buying patterns

- develop new features that drive sales and market share

- determine product functions that do not work, do not work well, or that could be eliminated to increase profit

- identify, predict and optimize buying-influence factors

Customer Interviews

Email Responses

Support Requests

Sales

Calls

Customer Reviews

Competitor Reviews

Qualitative Insights

The best practices and strategies for gaining qualitative and quantitative insights are missed by many companies because they are unknown or they require extra effort. Conducting customer interviews, sending out email response requests and surveys, digging into the support request inbox, actually sitting in on and taking notes during sales calls and evaluating both negative and positive review content are the comprehensive measures savvy marketers can take to evaluate qualitative data.

Quantitative Insights

Quantitative analysis involves measuring actions customers take, and sometimes measuring what they type. Measuring site search, website and product behavior can reveal important dichotomies that can deepen insight especially when customer behavior is in stark contrast to what they say.

Site Search

Website Usage Data

Product Usage Data

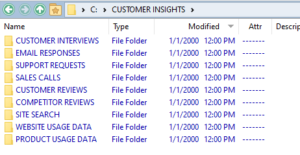

How To Gather Insights

Start by creating a CUSTOMER INSIGHTS directory that resides in a place you will be able to easily and continuously access. Then create subdirectories of each insight source and start collecting. Just take text notes while evaluating each insight area. Developing customer insight data is as straightforward as taking notes referencing files, documents, spreadsheets, emails, recordings, testimonial copy and usage analytics.

Start by creating a CUSTOMER INSIGHTS directory that resides in a place you will be able to easily and continuously access. Then create subdirectories of each insight source and start collecting. Just take text notes while evaluating each insight area. Developing customer insight data is as straightforward as taking notes referencing files, documents, spreadsheets, emails, recordings, testimonial copy and usage analytics.

Customer Interviews

Jobs-to-be-done (JTBD) conversations uncover dissonance between a user/customer and a condition or need in their life. Your product or service resolves this dissonance in a thorough JTBD analysis.

Your product’s ability to resolve customer pain is it’s USP in the marketplace, positioning it to win.

Thorough JTBD analysis probes to uncover customer challenges, frustrations, worries, anxieties, and pains in relation to your product or service. It asks for customer insight into available and possible solutions, what they’ve tried, and what they might envision. It probes for customer goals and desired optimum outcomes

This JTBD narrative is then used to specify possible improvements to the product or service. Companies can save time and money being careful and thorough in this stage.

Improving a product based on JTBD data:

- promotes faster design and development by knowing detailed customer desires up front

- becomes less expensive than product development based on developer belief without market analysis

- building product prototypes or limited runs without JTBD data will multiply costs from concept to market

JTBD analysis profiles customer friction and frustration providing insights marketers use to persuade prospects to buy.

Email Responses

Popular email survey best practices suggest developing an “engaging” subject line. However, it is more effective to develop subject lines that speak to customer pain. Engaging subject lines attract attention, but pain point subject lines offer higher psychological value and better survey results.

Product benefits in the subject line can achieve this better than generic “Your opinion matters. We want to hear your thoughts” subjects. Where it makes sense, try to create subject lines that speaks to detailed product use.

Use results can achieve pain point focus depending on the product. Asking about clean rugs instead of the vacuum cleaner can psychologically focus the prospect on the pain point dirty carpets present.

Support Requests

Both historical and current support email can yield valuable insights into common frustrations and product use issues. Spending even a brief time taking notes on commonly mention issues can drive traffic-magnet content development.

Sales Calls

Recorded or Live

After Covid drastically increased digital communications, many companies record some or all sales calls. Spending time taking notes from sales calls or recordings can uncover nuance and detail nothing else will.

True nature of win/loss exchanges

There is value hearing business development representatives on live phone calls with prospective clients. You’ll hear them discuss features, benefits and objections that can powerfully impact marketing messaging. Sales calls point marketers toward resonant issues other methods don’t uncover.

Competitor Insights

You can not only hear how product features resolve customer pain points, but also uncover those features that may not exist or are superior in a competitive offering that can be addressed to your advantage in nurture, win-back or promotional content.

Customer Reviews

- 360 degree comprehension of both good and bad review content

- Previously unknown or not featured product functions or uses customers are mentioning

- Article topics that focus especially on new or lesser known features

- Missing product perceptions or incorrect information found in negative reviews

- Holistic product use and feature need insight

A strategy that may be effective is to find ways to get especially positive reviews in front of incoming prospects coming to your website. There are social proof platforms that can leverage reviews from review platforms or from owned media sources.

Competitor Reviews

- Propose effective improvements users ask for

- Avoid wasting time trying to satisfy poor-fit customers

- Promote and maintain a satisfied customer base

- Provide management closed-loop insight into current operations

An important marketing task for competitive advantage is to monitor gaps in content and keyword phrase targets between you and your competitor(s). This analysis can also be done for earned content (testimonial) reviews.

Analyze your review content for use or other insights in testimonials both good and bad. Then dig into competitor reviews and note discrepancies especially between the severity of your negative review content compared to theirs.

These 360 views of testimonial content on all review platforms will broaden your perspective to then more closely target customer pain points in content development.

Site Search

If you have a fairly mature website, your traffic would or does perform searches for your content on it. This is increasingly common as CMS tools that have site search built in like WordPress become more widely used and consumers are increasingly finding and using it.

Local, on-site search reports are actionable by marketing teams as they:

- Reveals customer voice. Analyzing the queries people type into local site search can provide marketers clues into the terms customers use to identify and how they talk about JTBD tasks.

- Reveals keyword phrase priority. In one SaaS company their local site search history report showed terms they would never have considered and synonyms that that were missed.

- Reveals missing content. Seeing multiple instances of a term that is less than adequately covered can provide content calendar topics to increase website engagement. Often in-market traffic defines terms differently so some site content may need to be edited to more closely match customer voice.

- Reveals content popularity. Searching on site can indicate desire for more content in general. Site search is growing but relatively new and for especially sites with a smaller content footprint and/or low traffic, site search is a strong actionable indicator.

Site search implementation in GA4 is easy:

Log into your Google Analytics account, click Admin, click Account Views in the second column, then scroll down to ‘Turn On Site Search’ at the bottom.

Contact Us

- We never sell or share email addresses.

- Stays on same page.